On the Verge of Change: 1848-55

Originally published in The Numismatist, April 2013

The years leading up to the American Civil War were a turbulent time for the country’s currency.

Any article about the money in use in the United States before the Civil War should begin with the acknowledgment of the powerful effect California had on the course of events leading up to the conflict. In early 1848, John Marshall discovered gold in the American River in the Mexican state of California while constructing a saw mill for John Sutter. It was just a few weeks before the Treaty of Guadalupe Hidalgo dictated the terms of the end of the war with Mexico on May 30, 1848. The treaty provided the United States with much of the present-day Southwest, including California, Nevada, Utah, Arizona, New Mexico and Texas.

Until 1848, Congress dealt with the issue of the spread of slavery through careful negotiations and compromises. Every new “free state” admitted to the Union was to be balanced with a new pro-slave state. With the land the United States acquired in 1848, a fierce debate arose about which areas would have slaves and which would not.

Texas wanted its territory to extend to the Rio Grande river in present-day New Mexico, while residents of the Territory of New Mexico wanted to expand into present-day Texas. Some thought California should be divided into two states (a slave-free North and a pro-slave South), and the recently settled Mormon territory of Deseret desired the area encompassing California to what is now Colorado.

U.S. Senators Henry Clay (Whig-Kentucky) and Stephen Douglas (D-Illinois) promoted a compromise based on the concept of “popular sovereignty” that allowed residents of California and future states to decide whether they would be free or slave states. To balance this, they included the Fugitive Slave Act, which required free-state residents to return fugitive slaves to their owners in slave states. One of the act’s detractors was President Zachary Taylor. An impasse was resolved when he died in office in July 1850, and the Compromise of 1850 was signed into law by President Millard Fillmore.

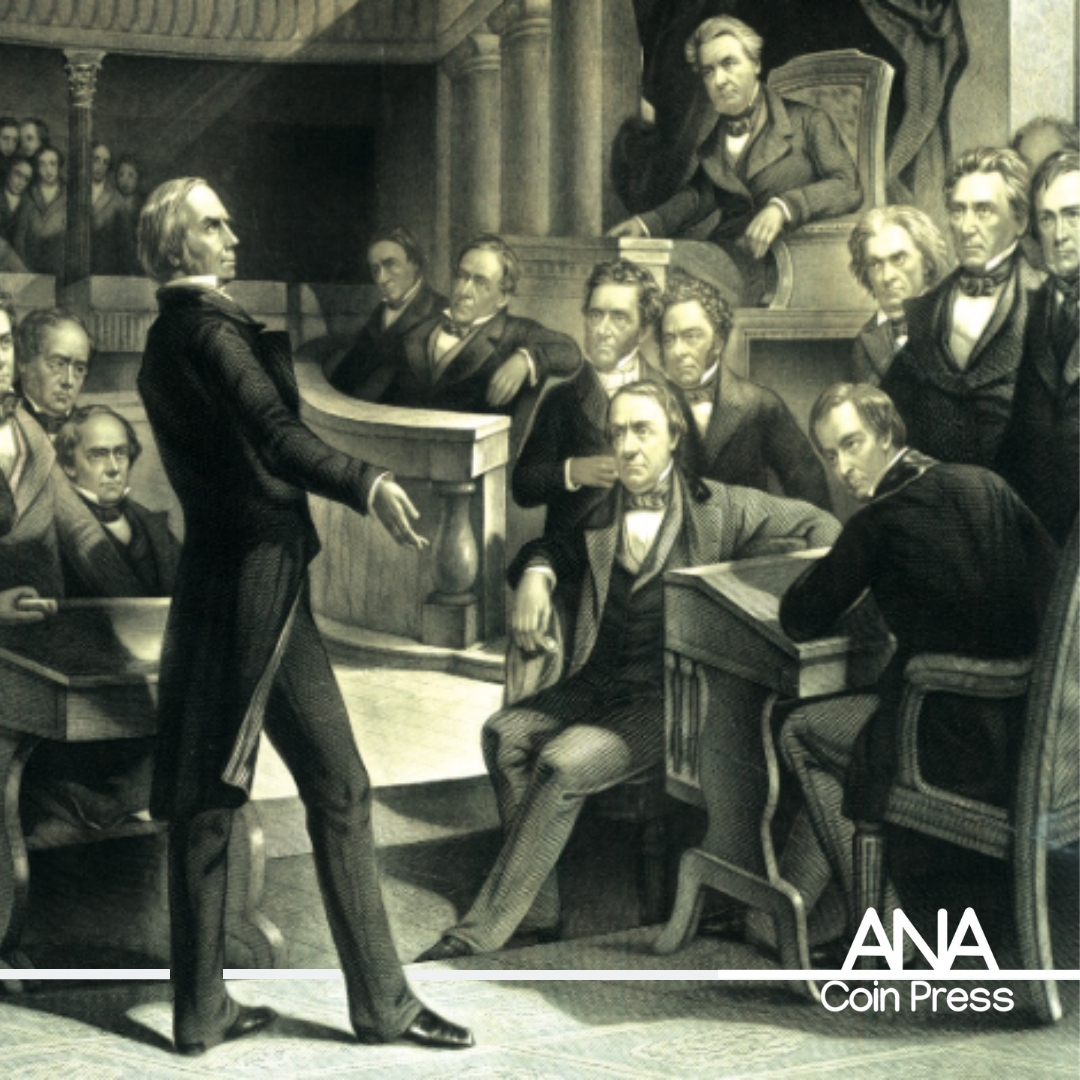

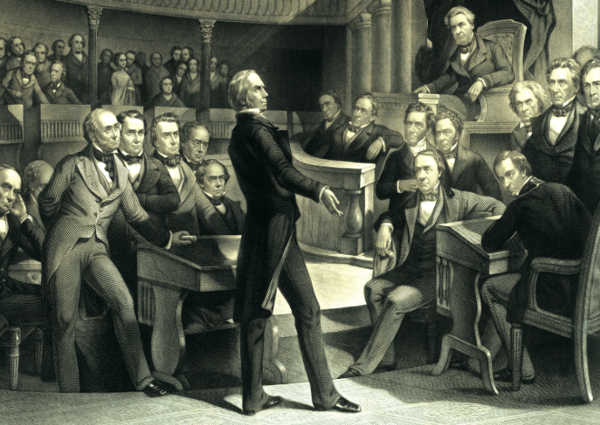

▲ AN 1855 PAINTING shows Henry Clay addressing the U.S. Senate. Clay and Stephen Douglas developed a compromise plan called "popular sovereignty" that allowed the creation of the single state of California and other states in the future. Photo: Library of Congress

The sectional differences between the North and South were otherwise fairly mild during this time. It appeared that popular sovereignty was the answer to the debate about slavery’s expansion in the United States. In the presidential election of 1852, which pitted two Mexican War Generals—Franklin Pierce, D-New Hampshire, and Winfield Scott, Whig-New Jersey—against one another, both candidates supported the Fugitive Slave Act and the Compromise of 1850. Pierce won a resounding victory, and Scott’s party fell apart and faded into history.

The Economy, 1848-53

In 1848 the United States, apart from its cities, was a diverse collection of mostly agricultural communities. Newspapers were distributed primarily to their local regions, so most people were ignorant of the way of life in other parts of the country. This disparity of information created great differences in the attitudes and opinions in more rural areas. Income tax was not paid at the time, as the majority of the government’s revenue was derived from customs duties.

This era is known as one of prosperity because of the quantity of gold coming from California, beginning in 1849. Banks and businesses in the East prospered due to the expansion of the gold supply. The number of banks and the currency they issued increased greatly, and railroad speculation grew investors’ wealth.

The nation’s coinage was based on a bimetallic system that valued gold over silver at a ratio of 16 to 1. Although silver was slightly overvalued by 1 percent, it was not enough to lead to the wholesale exportation or melting of coins.

The nation’s silver pieces were slowly replacing the Spanish coins in circulation. Larger silver coins, such as the American half dollar, the Spanish dollar (8 reales) and the 4 reales were stockpiled in banks. The American silver dollar typically was used for export purposes, usually ending up in China, where it was prized for its intrinsic value, reaping traders an extra 1-percent profit. The coin was not commonly seen, even at banks.

The nation’s silver pieces were slowly replacing the Spanish coins in circulation. Larger silver coins, such as the American half dollar, the Spanish dollar (8 reales) and the 4 reales were stockpiled in banks. The American silver dollar typically was used for export purposes, usually ending up in China, where it was prized for its intrinsic value, reaping traders an extra 1-percent profit. The coin was not commonly seen, even at banks.

The quarter dollar did not circulate as widely as its Spanish equivalent, the pistareen, or 2 reales, popularly called “two bits.” ◄ Photo left, courtesy Heritage Auctions. The bit, or one real, had a value slightly more than a dime at 12 1⁄2 cents. (The U.S. dime was called a “short bit.”) In the South, the half dime was called a “picayune” and was similar to the tiny half real, or “half bit” (medio in Spanish), which was valued at 6 1⁄4 cents. The dime and half dime generally were accepted at par with their heavier Spanish counterparts. The small-denomination, Spanish silver coins actually were devalued by this process. After 1845, New York banks accepted Spanish silver coins at 5, 10 and 23 cents, a practice the U.S. Post Office followed. By 1848, this practice was accepted everywhere.

When gold was discovered in California in 1848, things began to change. In December of that year, 228 ounces of newly mined California gold were sent to the Philadelphia Mint, where the precious metal was coined into two large medals for President Zachary Taylor and General Winfield Scott, the victorious generals of the Mexican War. The remaining gold was struck into 1,389 quarter eagles (gold $2 1⁄2) with a “CAL.” counterstamp on the reverse. These rightly can be called the nation’s first commemorative coinage. ► Photo right, courtesy Heritage Auctions.

When gold was discovered in California in 1848, things began to change. In December of that year, 228 ounces of newly mined California gold were sent to the Philadelphia Mint, where the precious metal was coined into two large medals for President Zachary Taylor and General Winfield Scott, the victorious generals of the Mexican War. The remaining gold was struck into 1,389 quarter eagles (gold $2 1⁄2) with a “CAL.” counterstamp on the reverse. These rightly can be called the nation’s first commemorative coinage. ► Photo right, courtesy Heritage Auctions.

The total amount of gold extracted in California by 1857 was valued at $477.5 million. A nearly simultaneous gold rush in Australia added a similar yield to world markets. This flood of the precious bullion created an imbalance for all currencies. By 1851, the gold-to-silver ratio had shrunk to 15.45 to 1.

When gold’s rarity dropped, the price of everything else rose. The effect was inflationary. Silver and copper climbed in value with respect to gold. In 1851 it became profitable to melt nearly all silver coins. Even worn Spanish issues were not immune to the worldwide mass-melting that the California and Australian gold rushes initiated.

The gold dollar was created in 1849 to address the absence of its silver sister. The small coin became the most common U.S. gold piece in circulation. To economically convert the flood of gold into coinage, the double eagle (gold $20) also was created that year, but was not placed into circulation until 1850. The double eagles were intended to be stored in bank vaults or used for export trade. Foreign gold coins primarily were kept in banks to back currency and were valued according to their weight.

▲ GOLD RUSHES IN BOTH CALIFORNIA AND AUSTRALIA resulted in an abundance of the precious bullion. As gold's rarity dropped, the value of silver and copper rose, leading to worldwide melting of the two lesser metals. Illustration: Library of Congress

A curious silver 3-cent coin, the trime, debuted in 1851. It’s silver fineness was only 75 percent, and its intrinsic value was well below its face value. The coin was created specifically to advantageously redeem bits and half bits at the 12- and 6-cent rate, respectively.

▲ THE REDUCTION IN THE POSTAL RATE in 1851 from 5 to 3 cents encouraged the use of the trime. Photo: Heritage Auctions

The United States Mint bought the silver for the trime on its own account, which was something new. At the time, the Mint operated as an assay office for banks and the general public. For a small fee, people could have the Mint strike their gold and silver into shiny, new U.S. coinage. This practice created a modest profit for the Mint. The authorizing Mint Act of March 3, 1851, reduced the postage rate from 5 cents to 3 cents, which encouraged the trime’s use and its production.

By 1852, full-weight silver coins had been hoarded, melted and exported for several years, and only well-worn pieces circulated. (The absent coinage was not completely gone; it circulated whenever hard money was in demand. In New York City, for example, Tammany bosses required that their graft payments be made in silver and gold.) Nevertheless, the tiny trime remained, and the coin soon became the predominant silver piece in circulation. Because its denomination fit well into pounds, shillings and pence, some feared the trime would perpetuate the English system that had been used in parts of the country since colonial times.

The international price of copper was rising, making the production of half cents (never a popular denomination) and cents more expensive, thereby reducing the Mint’s profits. In 1850 the U.S. Mint began experimenting with cents made out of billon, a low-grade alloy consisting of a mixture of silver and copper. (These particular pieces were 10-percent silver.) The center hole in the coins made them appear larger and made it possible for the pieces to be strung on a string or piled on a post. In 1853 the Mint tried German silver (nickel, tin and zinc) as an alloy for the cent.

None of these experiments were successful. By 1854, Mint officials were thinking about reducing the cent’s size from 175 to 100 grains. A beautiful Flying Eagle design modeled after Titian Peale’s 1836 drawings was used. (Curiously, in the same year these patterns were struck, a backstage political feud between Titian’s brother, U.S. Mint Chief Coiner Franklin Peale and Chief Engraver James Longacre was coming to a head. Franklin Peale would lose his job in 1854.) These experiments continued in 1855, but none of them amounted to any change in the nation’s coinage.

Imagine the following situation in 1852: no full-weight silver coins could be found. Tiny gold dollars, and maybe some quarter eagles, were on hand. However, if someone wished to purchase an item that cost less than $1, he only had equally tiny trimes and the dregs of Spanish silver bits, half bits and perhaps a few dimes and half dimes that were too worn to melt. The large copper cents were available, but they were cumbersome to carry. All the while, since 1851 in fact, Congress had been debating what to do about the situation. Help could not come fast enough.

The Coinage Act of 1853

When Congress finally did act, it came in the form of the Coinage Act of 1853. This act reduced the weight of the subsidiary silver coinage nearly 7 percent. The value in gold of one dollar’s worth of silver coins dropped from $1.04 to 97 cents. The legal-tender limit of the new issues was set at $5. In a nod to preserving bimetallism, the silver dollar was kept at the old standard. (It didn’t circulate, so no one noticed.) The trime was upgraded to 90-percent silver, and a new gold coin, with a value of $3, was struck. The piece was thought to be a useful denomination, although from today’s perspective it seems odd.

The Coinage Act also stopped the free coinage of silver. It was stipulated that the precious metal be bought only from the U.S. Treasury’s account and that silver coins would be paid out for gold. The Mint would reap the profit between the intrinsic value and the face value.

▲ THE REDUCTION IN THE POSTAL RATE in 1851 from 5 to 3 cents encouraged the use of the trime. Photo: Heritage Auctions

In practice, not much had changed, since Mint Director James Snowden defied the law and bought a tremendous amount of silver for the new coinage at a very high valuation, sometimes more than the market rate. In order to strike this massive amount of coinage, the Mint temporarily halted the production of copper cents.

The reverses of the silver quarters and half dollars now sported a shower of rays behind the eagle, and arrows were added to the dates of all the new silver small denominations to identify the change in weight. In 1853, for the first time in our country’s history, the quarter dollar was seen in circulation more than the pistareen.

By 1855, the circulating-coinage situation had settled down some. Silver coins were abundant, and small gold issues also were plentiful. Spanish silver still circulated, but to a lesser extent than in 1848. Trimes were seen less often. Even though Spanish silver was becoming a minority in general terms, it still was the most-often spent coin because of its lessening redemption value. (Compare this to a monetary rendition of the game “hot potato.” If you had a U.S. quarter and a Spanish pistareen, you would spend the Spanish piece first, as it was the least desirable.) Copper coins also were available since the Mint kept making them in increasingly larger quantities. The price of copper averaged 20 cents per pound in 1850-54. In 1855 it shot up to 28 cents per pound, which subtracted from the Mint’s bottom line. This was a problem that would need to be addressed.

Coinage in New England, 1848-53

The circulating coinage people saw in 1848 depended largely on where they lived. In New England, for example, copper cents were everywhere, although they were welcomed only by necessity. (Their large size made them cumbersome to carry.) The occasional cent-sized token made by button companies in places like Waterbury, Connecticut, still could be found. Half cents were very rare in circulation. Few chances to spend either the tokens or half cents existed, so they were thrown into drawers and never seen again. And although collectors love copper coins today, circulating specimens likely were grimy from decades of use. Many proper ladies and gentlemen refused to touch them.

▲ LARGE CENTS SOMETIMES WERE CUMBERSOME to carry. Proper ladies and gentlemen often refused to touch the grimy, well-used coins. Photo: Heritage Auctions

The federal silver coinage people encountered likely were half dimes and dimes. These were slowly replacing the once-ubiquitous Spanish coins. (The word “dime” was coming into regular use, having been placed prominently on the coin in 1837.) The Spanish bit traded at the same value, so a New Englander once would have called a dime a “bit.” The Spanish bit had the advantage of being omnipresent and long-lived. Everyone knew its value. Most of the Spanish coins in circulation dated from significantly earlier times, and the more worn specimens saw greater circulation because their owners used them first in everyday business transactions.

Bank Notes in the Northeast

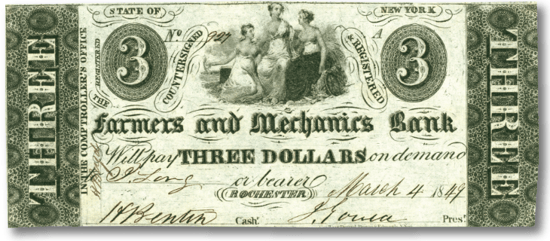

This renewed sense of prosperity during the early 1850s made it easy for new banks to open and issue their own currency. In 1848 about one-third of the money in circulation in the northeast was in the form of private bank notes. By 1853, these were the typical medium of exchange. If the banks were well known and relatively local, their notes were readily accepted at rates that varied widely from town to town. For example, in New York City, notes issued by local banks may have been received at face value, while the same notes would be accepted at three-quarters face in Philadelphia. The farther away you were from the bank’s location, the lower the rate.

▲ IN 1848 ABOUT ONE-THIRD OF THE MONEY circulating in the Northeast was in the form of bank notes. This $3 specimen was issued by Framers and Mechanics Bank of Rochester, New York. Photo: ANA Museum

The soundness of the issuing bank also supported a note’s value. Rates for various bank notes were posted in financial papers. The major banks in New York and other major cities held about 10 percent in gold and silver to back their currency.

Currency in the Great Lakes Region

In what then was called the western frontier— Illinois, Indiana and Michigan—banks were not so well established. Most opened with promissory notes or paper, not gold or silver coins. This paperbacked banking boom mushroomed during the 1850s. While some states had a charter system to oversee the extension of credit to banks, many states did not. Some of the financial organizations were outright frauds. They were established on worthless stock, collected gold and silver deposits, and issued paper money that was pushed on travelers in the hope they would never return to the area. When they did, or the local trust was broken, the bank folded overnight.

Currency in the South

In the South, the primary circulating coin was the silver Spanish dollar, or 8 reales (known as a “piece of eight”), and its fractions. Silver entered the country through main ports of entry in Charleston, South Carolina, and New Orleans, Louisiana.

The cotton trade provided Southern banks with enormous quantities of silver and gold. In 1850 the value of the cotton crop was estimated to be more than $100 million. By comparison, sugar and rice accounted for $15 million. Cotton plantations typically used a form of country pay to offset their needs with their profits. Their balance was held in banks, as they didn’t need as much currency to manage their plantations and farms. A large cotton plantation with 500 slaves could generate over $100,000 annual profit for the owner. This wealth drove land and slave prices to new heights in the cotton-growing regions of Georgia, Alabama and Mississippi. A good field hand sold for about $800 in 1848 and $1,500 in 1853. The sale of slaves from border states to plantation owners in the cotton-growing areas made millionaires out of many a trader.

▲ THE COTTON TRADE provided plantation owners and Southern banks with great quantities of gold and silver. Photo: Library of Congress

Few federal silver coins were seen in the South because most of the movement of money was through the Southern ports. Local gold from mints in New Orleans, Dahlonega and Charlotte were available in the cities, but rarely was found in general circulation. (Spanish gold was encountered more often.) Copper coins were scarce and typically shunned. They remained in storage because they were not useful in commerce, and hoards of the unwanted pieces are well known.

The Compromise of 1850 included a land deal that gave Texas $10 million to pay off the debt it incurred to obtain its independence. The region’s border was carved out of a much larger territory in exchange for the money. The notes and loans made by the Republic of Texas prior to 1848 were to be repaid on a scale based on the type of notes or bonds. Interest-bearing notes were to be paid in full. The 1839 Government of Texas bills (“redback” notes) were redeemed at 25 cents on the dollar, which was a windfall to their holders, since they had dropped to 12 to 15 cents prior to their redemption.

▲ REPUBLIC OF TEXAS "REDBACKS" were redeemed at 25 cents on the dollar, a windfall considering they has dropped to 12 to 15 cents on the dollar earlier. Photo: ANA Museum

The United States paid the land deal in two $5 million bond payments. These bonds, and their interest coupons, traded as currency for a while. However, the Texas government used the first payment to satisfy its debts, canceled the rest, and kept the remaining bonds for future investment.

Currency in California

In 1846 the few residents of what would become San Francisco mostly used Spanish silver pieces struck at the mint in Mexico City. With the area now part of the United States, the popula-tion began to increase dramatically. When gold was discovered in early 1848, rapid inflation ensued. A land parcel that sold in 1847 for about $100 was worth about $300,000 in 1853. The price of food, lodging and tools all rose dramatically.

Newcomers to the region brought coins from their former homes, but these were mere trinkets compared to the prices asked for items in San Francisco. The lowest denominations used were quarter-sized silver coins, such as the Spanish pistareen, French franc or English shilling. All three traded for the same amount. Since silver coins were treated as minor change, they were exchanged without much regard to their actual weight. No copper coins were used.

Californians traded their gold by weight at $16 per ounce. For small purchases, a pinch of gold dust equaled a few dollars. (It paid to have thick fingers!) Every merchant, saloon and gambling hall had scales to facilitate business. Private minters, like Miner’s Bank, Moffat & Company, and Norris, Gregg & Norris, were soon converting the raw bullion into bars and $5 and $10 coins. (The latter were popular in gambling halls.) Quantities of foreign gold coins, brought to the area by immigrants, also circulated and traded for their weight. Ingots were produced (usually for the larger denominations) and did not have a standardized weight like coins did.

The lowest day’s labor wage was $1 per hour, and a carpenter could demand $14 to $16 per day. The cheapest boarding (consisting of a plank “bed” and 30 other guests to a room) was $20 a week. A loaf of bread, which in New York cost consumers 4 cents, ran 50 cents in San Francisco. With much of the population transient, either heading to or coming from the gold fields, few real homes were available in the city. Destitution was a big problem for those who couldn’t work and, not surprisingly, crime was rampant.

With statehood anticipated in 1850, Frederick Kohler, who just months earlier was issuing coins for Miner’s Bank, was appointed California state assayer and began issuing ingots. These were high-denominated bars (called “slugs”) of varying weight, with their value stamped on each. Kohler’s old minting operation was sold to the jewelry firm of Baldwin’s, which began producing $5 and $10 coins. The state declared that only its assay-office bars were legal tender, and most of the earlier private coinage was quickly melted.

▲ THE SAN FRANCISCO FIRM OF BALDWIN & COMPANY produced $5 and $10 gold coins in 1850 and 1851. Photo: Heritage Auctions

In 1851 the federal government set up Augustus Humbert as the U.S. assayer of gold, putting the state’s assay office out of business. Moffat & Company was awarded the contract to mint gold coins for the U.S. government. In February, Moffat began striking $50 pieces, which inherited the moniker of “slugs” from Kohler’s bars. These were the largest standard-denomination coins issued by U.S. authority.

A controversy arose in early 1851 when it was publicized that quarter eagles and half eagles from 1849 and 1850 were not full weight. (This may have been more negative advertising than actual deception on the part of the early minters.) The coins were soon discounted as much as 8 percent. In fact, tests conducted by the Mint put them very close to full value. All the lesser denominations then were discounted and turned into Humbert slugs at Moffat’s assay office, making the $5 and $10 specimens from other firms scarce in circulation. Permission to produce lower denominations was needed from the U.S. Treasurer, but the go-ahead was not granted until 1852.

The firm of Wass, Moltor & Company was formed and began issuing small denominations in January 1852. To fill the void in the meantime, local jewelers began minting tiny gold specimens in 25-cent, 50-cent and $1 denominations. These coins were struck more for utility, and varied in weight and purity. They may have served a purpose in small-change transactions, but not to a great extent.

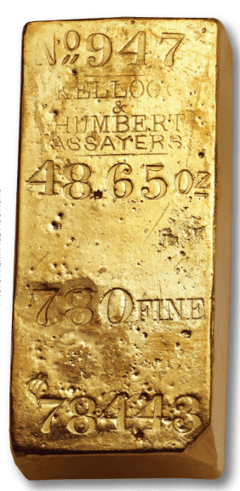

In July 1852, a branch Mint was established in San Francisco. (It did not open its doors until April 3, 1854.) Until its operations were up to speed, U.S. Assayer Augustus Humbert continued to produce coins. Wass, Molitor & Company struck $5 and $10 coins through 1855, although the company did not change the dates on its issues. In 1854 John Kellogg established an assaying firm and struck $20 denominations. The San Francisco Mint struck mostly $10 and $20 pieces.

In July 1852, a branch Mint was established in San Francisco. (It did not open its doors until April 3, 1854.) Until its operations were up to speed, U.S. Assayer Augustus Humbert continued to produce coins. Wass, Molitor & Company struck $5 and $10 coins through 1855, although the company did not change the dates on its issues. In 1854 John Kellogg established an assaying firm and struck $20 denominations. The San Francisco Mint struck mostly $10 and $20 pieces.

◄ CALIFORNIA ASSAYERS continued to make gold bars even after the U.S. Mint assumed the state's minting operations in 1856. Photo: Heritage Auctions

In 1855 Wass, Molitor and Company issued round $50 slugs in direct response to the failure of the Mint to get permission from the United States treasurer to produce the denomination. Kellogg attempted a $50 production, but only issued a few proof examples, which today are prized as the most beautiful of California’s gold coinage.

The U.S. Mint took over all gold minting operations in California in 1856. However, private assayers remained in business, making bars for transport to banks in the East.

Paper Scrip in California

California’s Constitution specifically outlawed paper money in the state after its acceptance on November 13, 1850, but that did not stop the nascent city of San Francisco. The town’s income subsisted on the sale of land, but most parcels were sold off by 1850. To entice people to work for the city— building plank roads and sewers, and serving in official posts—San Francisco issued scrip that promised payment, supposedly from land sales. These notes depreciated to about one-third their value, so to continue issuing the bonds, the city had to pay them out at three times their face value. By 1851, the notes promised an interest rate of 3 percent per month. In May 1851, the city issued 20-year bonds payable at 10 percent per year to replace the notes. In May 1852, a second series of bonds, issued at a 7-percent rate, was issued. As the notes depreciated further, holders were happy to convert them to the bonds and triple their money. After this, paper was not seen again in circulation in California until the 1870s.

Money of the State of Deseret

Mormon pioneers began settling in Utah’s Great Salt Lake area in 1847. When gold was brought to the region from California in late 1848, a small mintage of $10 pieces was made before melting problems caused production to cease. The Mormon church collected gold and, in its place, issued paper currency for general circulation in denominations of 50 cents, $1, $2, $3 and $5. Some notes carried the signature of Brigham Young, the Mormon church’s leader. Older bills from a Mormon settlement in Kirtland, Ohio, also were used in circulation, with some signed by Mormon founder Joseph Smith.

▲ THIS $5 GOLD PIECE was struck from the Mormon State of Deseret in 1849. The clasped hands on the reverse appear on most Mormon coins and represent friendship and strength in unity. The $20 issue of this type was the first coin of that denomination struck in the United States. Photo: Heritage Auctions.

When new minting equipment was procured in September 1849, coinage resumed, and most of the Deseret notes were redeemed for gold. Coin denominations of $2½, $5, $10 and $20 were produced. The latter was the first coin of that denomination struck in the United States. Coinage was produced for the church and the state’s residents, and continued until 1851.

Oregon Territory Coinage

In 1846 the Oregon Treaty defined the boundary of the Oregon Territory. After years of contentious political and military brinksmanship with Great Britain over the border with Canada, Oregon was divided along the 49th parallel. From the American point of view, half the territory (present-day British Columbia) was lost to Canada. From the Canadian point of view, the area north and west of the Columbia River was given to the United States.

About 13,000 people lived in the Oregon Territory in 1850, and it was growing rapidly. The local economy used the barter system. Some coins brought by settlers were used as well.

▲ PRIVATE BUSINESSES AND CITIZENS in Oregon were forced to strike their own gold coins after a proposed minting facility in Oregon City was declared unconstitutional. Photo: Heritage Auctions.

When gold was discovered in California, the people in Oregon were perfectly situated to quickly travel south to seek their riches in the gold fields. The raw bullion they brought back was as difficult to use in commerce in the Oregon Territory as it had been in California.

To standardize gold use, a mint was proposed in Oregon City, just south of present-day Portland, in February 1849. Before minting could commence, however, the newly installed governor of the area, Joseph Lane, declared the mint unconstitutional. This verdict forced the citizens to establish their own mint. Using crude facilities, they produced nearly $60,000 in $5 and $10 coins during the summer of 1849. The issues were struck on a $16.50-per-ounce scale rather than the $16-per-ounce standard used in California. This higher redemption value made the coins highly desired and profitable to export and melt. As a result, they became scarce after a short period and are rare today.

Collecting the Era

Hobbyists who specialize in numismatic items from this fascinating era, 1848 to 1855, can collect by state, region or denomination. A truly representative type collection should include at least a denomination set of Spanish coinage, and some examples of the paper money of the time. Type collectors of federal coins of the period will benefit from referencing general books like A Guide Book of United States Coins, and specialized publications about various denominations. Researching the history of certain banks and minters also will enhance the collecting experience.

Collectors of regional pieces should seek paper money, as well as coins from local mints. Charlotte and Dahlonega Mint gold coins are popular, but very scarce. Specimens struck at the New Orleans Mint would be appropriate, as would those from California. (Fractional gold coins and world issues that circulated in California can be acquired on a relatively modest budget.) Many federal coins from the San Francisco Mint also are available, while others are exceedingly rare. The private issues from Deseret and California are always expensive, but are generally rewarding to their owners. ■

Sources

Bowers, Q. David, and David M. Sundman. 100 Greatest American Currency Notes: The Stories behind the Most Fascinating Colonial, Confederate, Federal, Obsolete, and Private American Notes. Atlanta, GA: Whitman Publishing, 2006.

Bowers, Q. David, and Richard G. Doty. A California Gold Rush History: Featuring the Treasure from the S.S. Central America: A Source Book for the Gold Rush Historian and Numismatist. Newport Beach, CA: California Gold Marketing Group, 2002.

McMaster, John Bach. A History of the People of the United States, from the Revolution to the Civil War. New York: D. Appleton, 1883.

Rhodes, James Ford. History of the United States from the Compromise of 1850. London: MacMillan, 1904.

Soulé, Frank, John H. Gihon, M.D., and James Nisbet. The Annals of San Francisco. New York: Appleton, 1855.

About the American Numismatic Association

The American Numismatic Association is a nonprofit organization dedicated to educating and encouraging people to study and collect coins and related items. The Association serves the academic community, collectors and the general public with an interest in numismatics.

The ANA helps all people discover and explore the world of money through its vast array of educational programs including its museum, library, publications, conventions and numismatic seminars.